National Savings and Investments

Digital Transformation

PROJECT

Strategy & proposition

Digital platforms

Future service vision

ROLE

Experience/Product Design Director

AWARDS

Multiple Digital Impact Awards

URL

NS&I is a unique, 169 years old, government-backed, savings bank. They manage 207 billion pounds for 25 million savers, one in three people in the UK.

One of their much-loved products, Premium Bonds, is owned by over 23 million people.

Background

I was worked with NS&I for over 10 years. In that time, I was key in helping them come out of the Post Office, move to online platforms, and more recently establish a vision for future services and digital user experiences as part of a large-scale digital transformation.

The transformation has been challenging. As you can imagine, an organisation of this scale and history will have a huge number of obstacles to overcome in terms of legacy systems, processes, and incomplete data sets.

The journey so far

To do my work justice, I will give you a high-level overview of the projects I’ve led and been part of. You can drill down into some specific projects to see more about the processes and outcomes.

My part in the story

As well as leading all aspects of digital design across all product lifecycles, I was the glue between the organisation and its third-party suppliers. I managed to embed myself within the organisation to direct and influence all design decisions in the digital space.

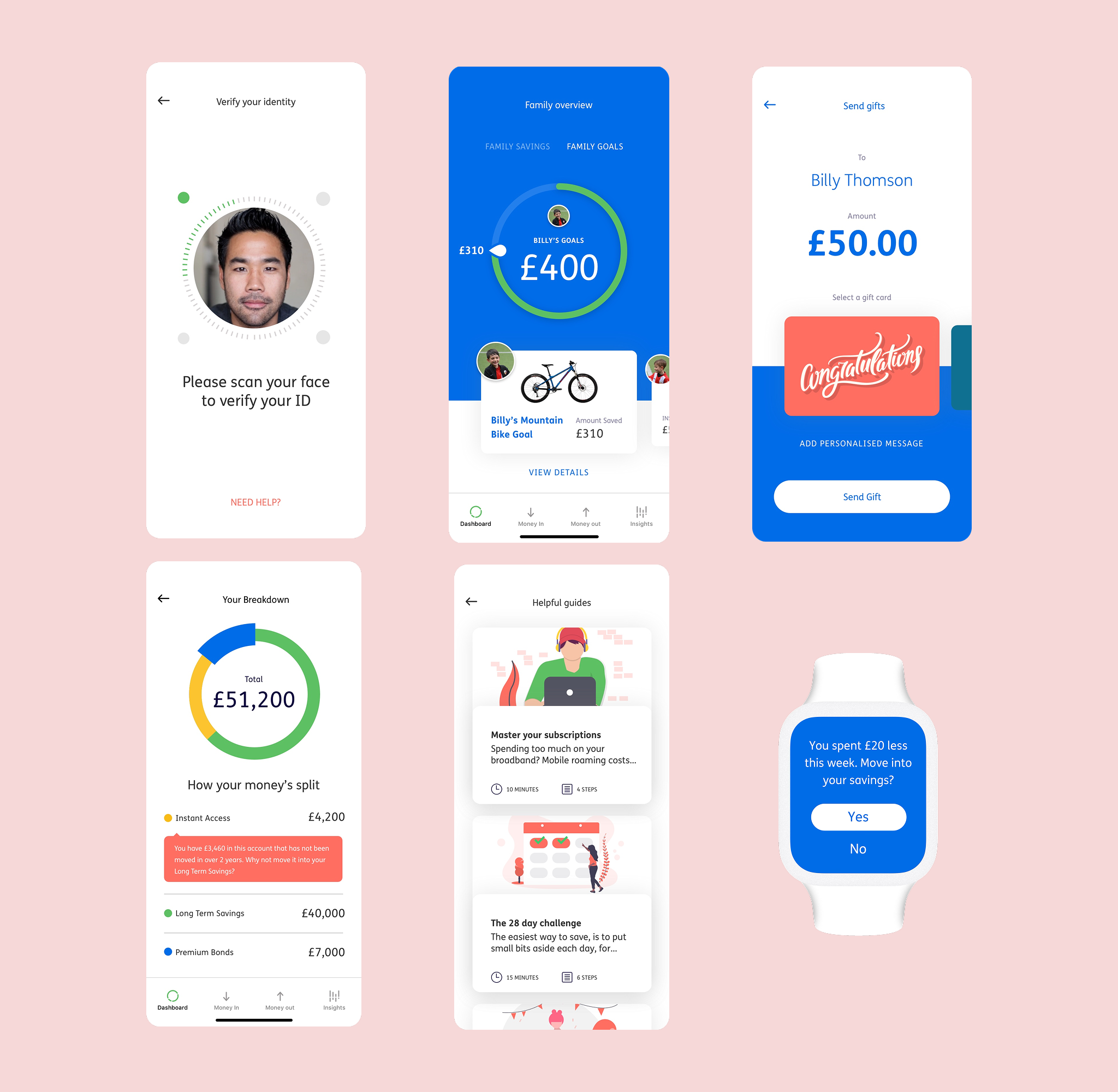

1.0-A new world

NS&I was ready to embark upon its transformation journey, but to secure the government's backing, we needed to present a future vision of the organisation to the Treasury. This vision would illustrate our North Star—demonstrating how NS&I must evolve to thrive in the digital age.

To support this, we created visual concepts showcasing the key areas where customers were least satisfied, such as signing up, pots and gifting.

2.0-Research

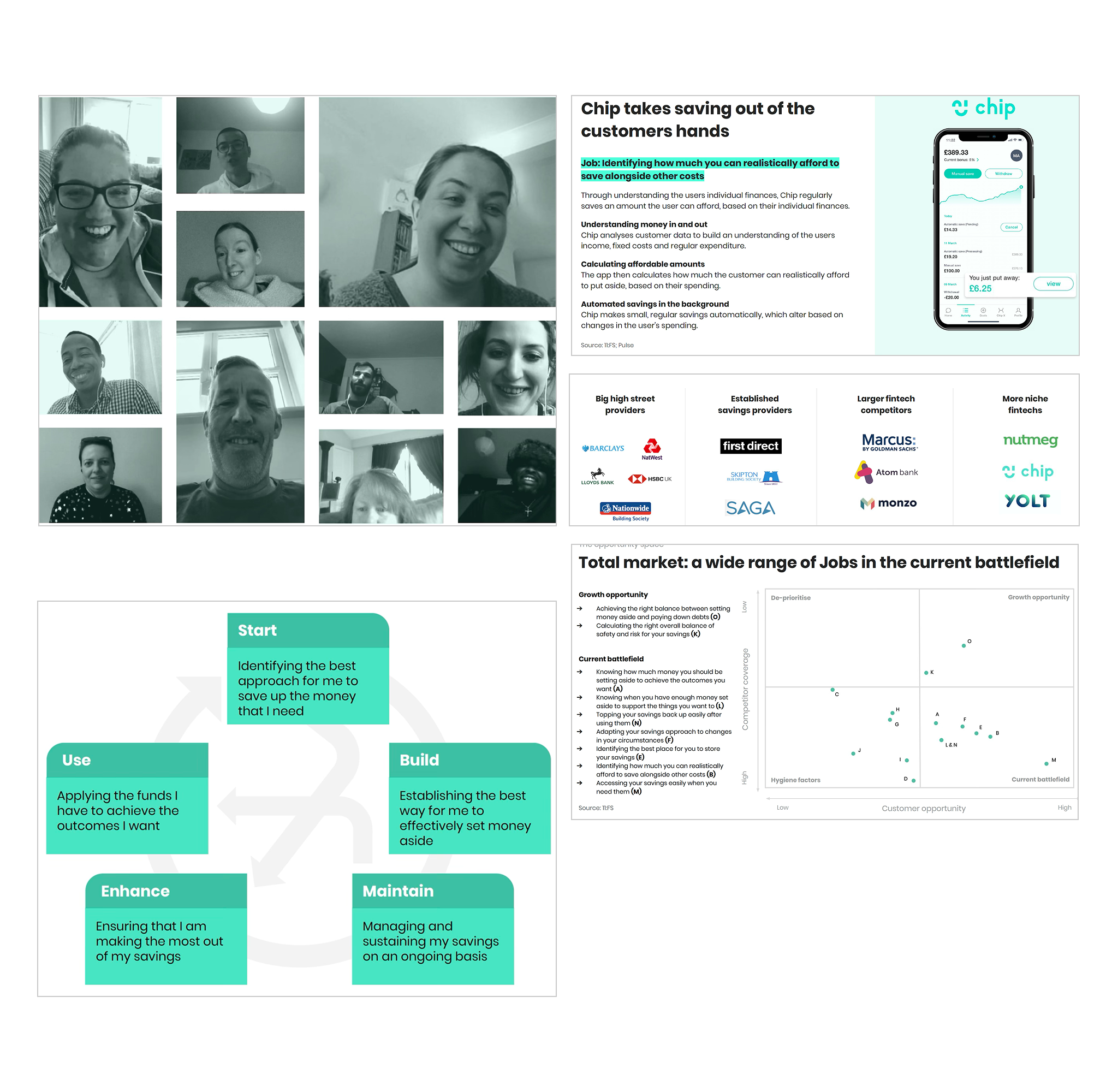

Once approved, we conducted extensive research using the Jobs to be Done methodology to understand the psychology and behaviours behind saving.

I worked closely with the client's research team to map the savings cycle and key tasks, based on 40 in-depth interviews and 1,500 surveys.

We also conducted market research to analyse what other providers offer and identify a unique position that NS&I can own within the market.

3.0-Personas

Through our research, a number of distinct personas emerged, providing valuable insights to guide our approach moving forward.

Rather than being defined by demographics, these personas were shaped by customers' attitudes, behaviours and motivations towards saving.

This shift in focus allowed us to design more tailored solutions that addressed real user needs.

By understanding these attitudes, we were able to create more meaningful and engaging customer experiences.

4.0-User journeys, ideas and testing

To gain a clear understanding of the landscape, we mapped out existing user journeys in a series of workshops to identify key customer pain points.

Using ideation techniques such as Crazy 8s and other methodologies, we designed a range of conceptual solutions to address these challenges. We then developed future user journeys and interactive prototypes, ready for testing.

5.0-Recommendations

We tested the concepts and ideas through one-to-one sessions, focus groups, and online surveys. From this, we gathered valuable insights and recommendations, which we incorporated into our prototypes to refine and enhance the user experience.

This iterative process allowed us to address key pain points, ensuring the final design was both intuitive and user-friendly. By continuously validating our assumptions, we created a solution that aligned closely with user needs and expectations.

6.0-A single source of truth

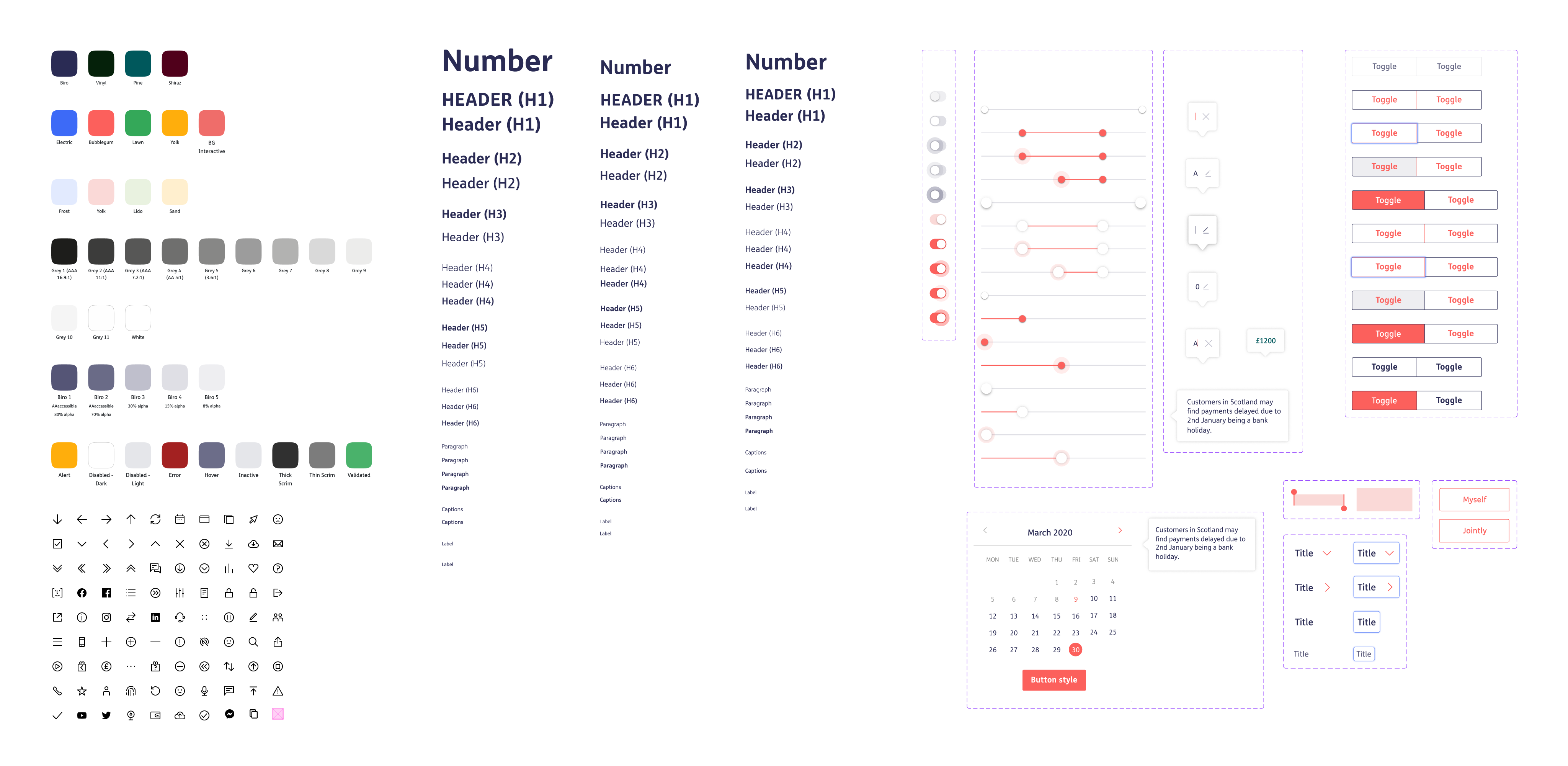

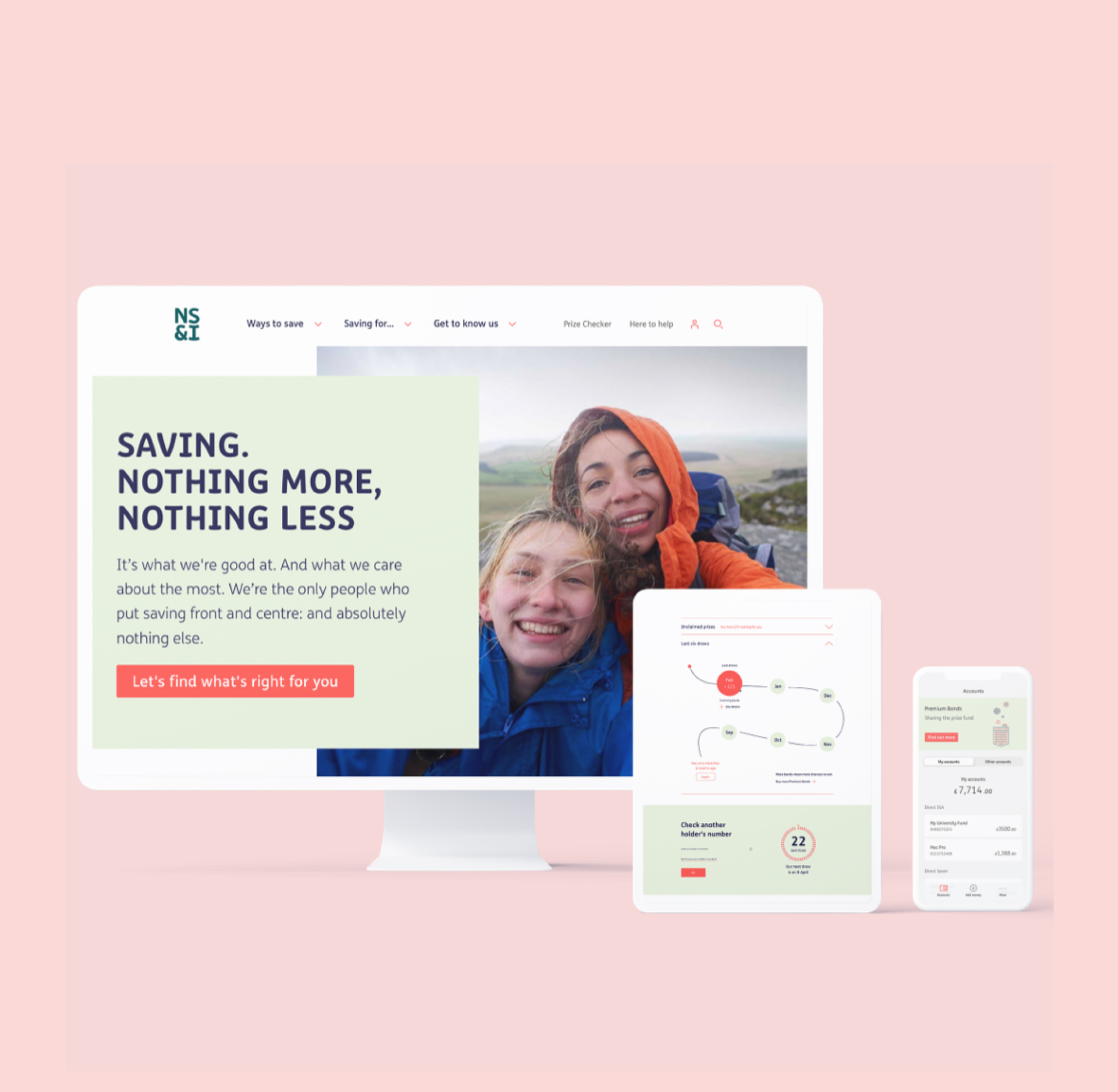

In a separate stream of work, we were rebranding the organisation, refreshing its brand proposition and visual identity.

My team and I were responsible for guiding the digital aspect of the rebrand, ensuring that colours were accessible and defining experience principles and motion guidelines.

We focused on creating a cohesive Design System that aligned with the new brand direction.

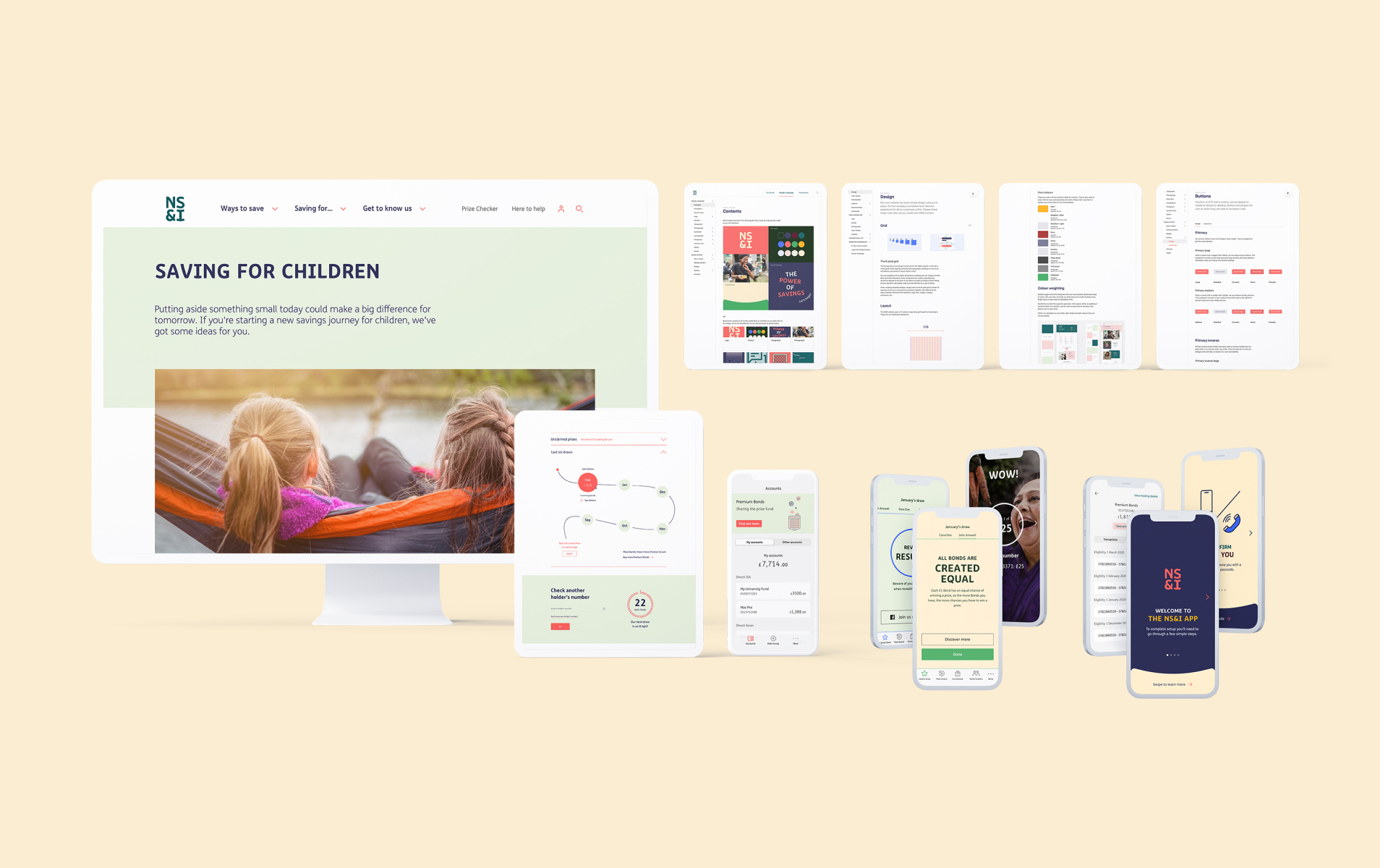

7.0-NS&I.com

The transformation is a multi-year programme of work. So far, the new strategy and brand have been rolled out across the main consumer website and parts of the mobile applications.

The consumer-facing website is one of the first major projects to get NS&I started on its transformation journey.

The existing website was dated and limited in terms of information. The architecture and navigation were not in a good place.

We decided to redesign the site based on business needs and user insight.

8.0-Mobile applications

NS&I has two separate mobile applications, one for banking functionalities and one for checking Premium Bond Prizes. We started with the banking app. It has been quite a slow process. Getting started with an MVP three years ago and it’s still quite a bit away from perfect. The agile process is ensuring that key features are added with every new release.

CASE STUDY COMING SOON

WHAT DID THE CLIENT SAY?

I worked with Kardo in my role at NS&I. His experience and perspective was absolutely invaluable. What makes him really stand out though is his genuine passion for solving his client's problems as a partner. His working style is not to arrive with an off-the-shelf solution but to listen, challenge, adjust, and stand next to you in what is often a battle to improve the approach to customer experience in an organisation.

Mercedes Clark-Smith

Head of (Service) Design and (Strategy) Validation at NS&I